Bitcoin has made its fair share of enemies since it was created a little over ten years ago.

The bitcoin price, soaring to around $20,000 per bitcoin in late 2017, thrust cryptocurrencies into the global limelight, prompting governments to clamp down on their use and companies such as Facebook to create their own.

Now, legendary investor Jim Rogers has warned bitcoin and similar "virtual currencies beyond the influence of the government" will not be allowed to survive—and said the bitcoin price is headed to zero.

"If the cryptocurrency succeeds as real money, rather than the subject of gambling as it is today, the government will make the cryptocurrency illegal and eliminate it," Rogers told Japan's Aera dot in comments translated by Google.

Rogers is perhaps best-known for co-founding the Quantum Fund, with fellow legend George Soros and has gone on to establish himself as a television and media personality.

Bitcoin, still mostly used as an instrument of speculation, has attracted attention in recent months as the coronavirus pandemic has spread and governments have taken extreme action to support their economies.

The U.S. has allocated almost $3 trillion for coronavirus-related economic aid and the Federal Reserve has pumped trillions of dollars into the U.S. economy.

Renowned investors including Paul Tudor Jones, Dan Tapiero and Raoul Pal have named bitcoin as a potential hedge against the inflation unprecedented central bank stimulus measures could bring, though bitcoin is still far from being used as "real money." Some 11 million bitcoin, roughly 60% of the current minted supply, has sat dormant for a whole year, according to a recent research report published by Digital Asset Data—suggesting investors are "buying to hold."

However, governments around the world, spurred on by China's efforts to digitalize its yuan and Facebook's plans for a bitcoin-inspired digital currency, have accelerated their efforts to take money and spending online. "The government likes electronic money," Rogers said. "Because with electronic money, you can track when, where, who spent what amount. Governments will have more control over people through electronic money."

"The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be erased."

Many in the bitcoin community see cryptocurrencies as a way of resisting government overreach and some fear a proposed digital U.S. dollar could hand more power to the state. Rogers' comments could throw fuel on those fears. "The government has something that those who work with virtual currencies don't have," Rogers said. "It's a gun."

The bitcoin price, still highly volatile and prone to wild swings, is increasingly being watched by Wall Street as they launch bitcoin and cryptocurrency services and take on clients in the space.

I do a good deal of reading every day and I share the best of what I find on Twitter. The purpose of this reading is not so much to find out what's really going on as it is to try to understand how people feel about what is going on. What are the trends and narratives that are important to market participants and where are they in their life cycle.

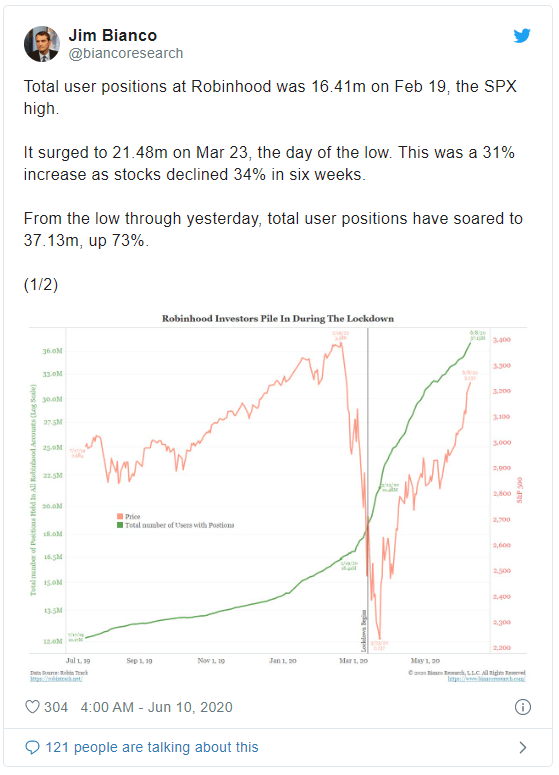

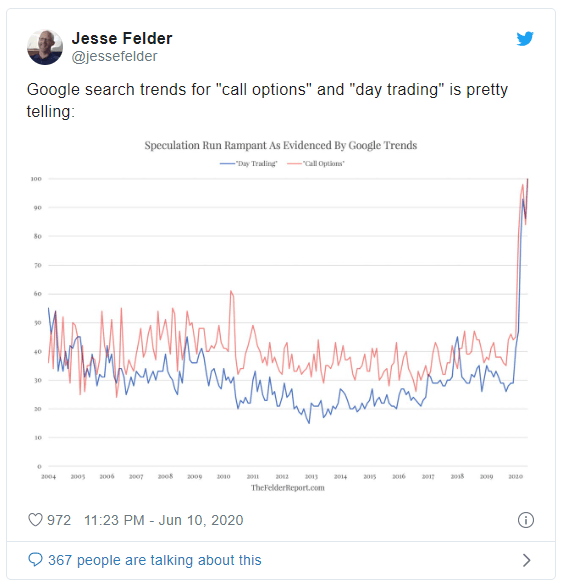

One trend I've been following for a while now is the growing participation in the financial markets on the part of young individuals. Since most brokers went commission-free, following in Robinhood's footsteps, the interest in trading has gone through the roof. This week feels like the narrative is reaching a crescendo.

So I thought it might be important to immortalize some of the stories in my recent Twitter feed in a blog post here. During the dotcom mania, my friend Bill Fleckenstein tracked the bubble in what he called, "The Mania Chronicles." Consider this my very limited version of the same.

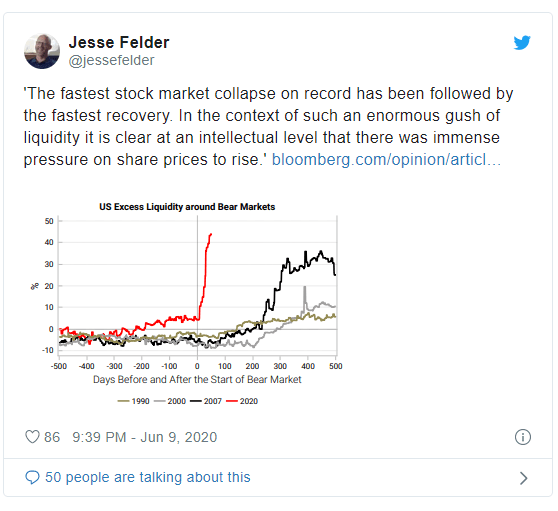

The stock market has set many records this year. After putting in the fastest 10% decline from a new high, it then put in the fastest 20% and 30% declines. Since then, however, it's now put in the fastest recovery from a crash in history.

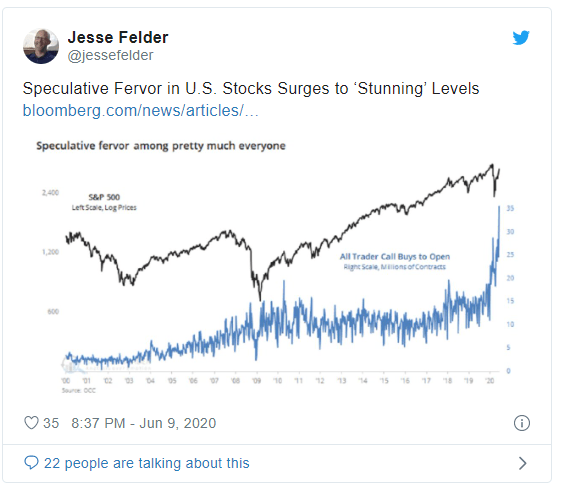

An unprecedented boom in money printing for the explicit purpose of supporting asset prices is certainly part of the reason for the recovery but it is also important to note what that money printing has inspired: an unprecedented boom in financial market speculation by retail traders.

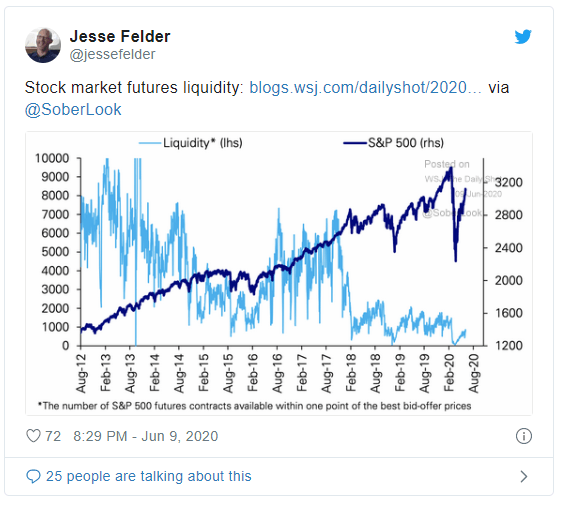

Combine massive money printing with mass speculation and record low liquidity (in futures and almost every other market) and you get the fastest 50-day rise in the stock market on record.

As a result, we now have an army of traders who believe they are the second coming of Warren Buffett. While the Oracle of Omaha now looks foolish for selling his airline stocks, those who bought them up over the past few months are gloating like you rarely see in this game.

Like Mark Cuban said, "everybody is a genius in a bull market," and the largest 50-day gain in history is minting a ton of geniuses right now.

To get a sense of the mindset of many of these traders, the Wall Street Journal spoke to a few of them and they make no bones about gambling with the funds the government sent them as part of the CARES Act, trying to double or triple it in just a day's time.

In 1999 and 2000, day traders went for the hottest internet stocks of the day in trying to make outsized returns; eventually many went bankrupt. Today, they're looking for outsized returns in the stocks that have already filed for bankruptcy protection!

But if there's a lesson from that earlier period, it's this:

This rally has humbled not only Warren Buffett but also Stan Druckenmiller, Sam Zell, Carl Icahn, Paul Singer, Jim Rogers and a host of other true geniuses of the industry whom have bet against it. It seems like it may soon be time for it to carry out those betting with it.