Jim has told me before that he’s interested in disaster… and he still is.

Kim: Jim, where do you see opportunity and good value today?

Jim: I have been shouting that North Korea and South Korea would soon merge for a few years now, and it looks like it’s finally going to happen. [Jim told us that he was bullish on North Korea in 2016.]

Not tomorrow. But unless Mr. Trump messes it up, and he might, that problem is being solved as we speak for many reasons. [North Korea’s leader and Trump are due to meet in a few weeks.] But that would certainly prevent American taxpayers from spending a lot of money… Korean taxpayers… it’d prevent everybody from spending a lot of money. So let’s hope it happens. I would be terrific. It would be a great opportunity for investors. In the North they need everything, they have nothing. Virtually nothing. So it would be a great opportunity for all of us.

You’re probably going to say to me, “What would you buy?” And there’s nothing to buy in North Korea, there’s nothing public I own. North Korean coins. I own Korean Air Lines (Korea Exchange; ticker: 003490) because I assume there’ll be a lot more air traffic. I own a South Korean ETF. [The iShares MSCI South Korea ETF (NYSE; ticker: EWY) is one ETF you can own.] But other than that, I don’t really know a way to invest.

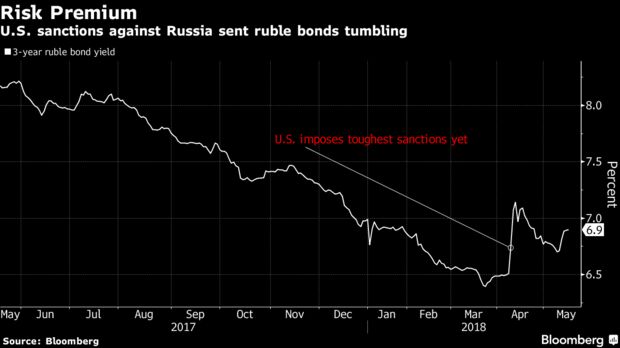

Also, Russia is still hated by most investors, which is terrific, it means it’s still cheap. I am looking for Russian investments. I’ve bought more Russian government bonds recently in rubles because they have a very high yield and I’m optimistic about the ruble – certainly that the ruble is making a bottom, if it has not made its bottom already.

Vietnam is doing very well right now. I prefer the bad things that are hated. But there are big changes in the country, and it’s right on the Chinese border. It’s a country of 90 million people, educated, disciplined, hardworking. They call themselves communist, but take that with a grain of salt.

I’ve mentioned Nigeria and Kazakhstan before.

China. I’m looking for investments in China. China is 40 percent below its all-time high. Japan is 50 percent below its all-time high. I’d much prefer China and Japan to, say, America and Germany. You know, these are markets that are near all-time highs. And I know that watching you guys, you know to buy low and sell high.

Jim mentioned Japan. So I asked him… when we look at debt profiles and countries most likely to blow up from debt, wouldn’t Japan be at the top of that list?

Jim: Absolutely. Japan has staggering internal debts. They have a lot of external reserves, foreign-currency reserves, but they have huge debt and they keep running up debt after debt after debt. I can give you scenarios where there isn’t a Japan in 50 years. I mean, they have a declining population. Their debt is going through the roof. It’s a fantastic country, but it’s in serious, serious decline.

But that doesn’t mean that the stock market cannot go up for a few months, or a year, or two. So I’d rather buy Japan than many other countries.

Kim: It sounds like you’re talking about the disconnect between the fundamentals of a market or an economy, and the direction or trajectory of its stock market.

Jim: There’s a difference in a short term and a long term. I know Japan is going to disappear, but there’s still time to make some money if the world doesn’t fall apart in the next three or 10 months.

- Source, Standberry Churchhouse