TRACKING THE COMMODITIES VIGILANTE AND AUTHOR, JIM ROGERS AN UNOFFICIAL TRACKING OF HIS INVESTMENT COMMENTARY

Friday, December 11, 2020

Market crash coming? Jim Rogers says not yet; invest in these ‘hated’ assets

Thursday, November 26, 2020

Sunday, November 22, 2020

The next bear market will be the worst in at least 78 years

‘It’s good to be old. Young people have a very bleak future ahead of them.’

That’s Jim Rogers, the 78-year-old co-founder of George Soros’s Quantum Fund, once again hammering home the idea that the flood of money flowing from central banks are artificially keeping markets around the world afloat and will ultimately lead to disaster.

“If you look out the window, you’ll see printing presses everywhere,” Rogers explained in an interview with the Peak Prosperity blog. “You know what happened to all the other countries in history that have gotten themselves deep into debt… it hasn’t been pretty.”

To gird against such weakness, Rogers pointed out that commodities, as you can see from this chart highlighted in the blog post, are offering an historic bargain relative to equity valuations:

“If you look out the window, you’ll see printing presses everywhere,” Rogers explained in an interview with the Peak Prosperity blog. “You know what happened to all the other countries in history that have gotten themselves deep into debt… it hasn’t been pretty.”

To gird against such weakness, Rogers pointed out that commodities, as you can see from this chart highlighted in the blog post, are offering an historic bargain relative to equity valuations:

- Source, The Market Watch

Saturday, October 31, 2020

Monday, October 26, 2020

Wednesday, October 21, 2020

Jim Rogers Shares 3 Tips to Survive Coming Economic Meltdown; Gold, Silver Will See Mania

"Learn about gold and silver because they will go into a period of mania," the author of Hot Commodities said.

"I'm always shocked to see how little people know about the world, money and investing," Rogers said speaking from his home in Singapore.

On the topic of the markets ahead of the U.S. election, Rogers said politicians will do anything now to keep it afloat, "you should be more worried about 2021."

- Source, Stansberry Research

Thursday, October 8, 2020

Investment legend Jim Rogers on China, Technology, and Global Finance

Described as Indiana Jones of finance by Time magazine, he spent many years traveling the world, developed financial acumen pertaining to frontier markets.

Consistently bullish on China, Mr. Rogers spoke with us amidst the global coronavirus pandemic about the on-going trade war and tech war between the US and China, the stimulus, and the future of global trade and finance.

With Huawei at the center of the global technology competition, Mr. Rogers shed wisdom, drawn from history, on the shifts of global technological leadership over the modern Industrial Era.

He believes that the best approach is to welcome global technological competition and for countries to continue to open up, including America and China.

Drawing lessons from the abysmal 1930s, he warned against the rise of isolationism and protectionism, spoke out against the relentless money printing by central banks, shared his optimism about China, discarded the idea that TikTok constitutes a security or privacy threat.

- Source, Hey China!

Sunday, October 4, 2020

Tuesday, September 29, 2020

Jim Rogers Shares 3 Tips to Survive Coming Economic Meltdown; Says Gold, Silver Will See Mania

"Learn about gold and silver because they will go into a period of mania," the author of Hot Commodities said.

"I'm always shocked to see how little people know about the world, money and investing,"

Rogers said speaking from his home in Singapore. On the topic of the markets ahead of the U.S. election, Rogers said politicians will do anything now to keep it afloat, "you should be more worried about 2021."

- Source, Standberry Research

Monday, September 14, 2020

Debt is Going Through the Roof and We Will Pay the Price

In 2008, the world had a big problem because of too much debt. Since then, the debt has skyrocketed everywhere, even in India and China. Ten years ago China had virtually no debt. Now they have got a lot of debt. Everywhere does. The next time we have a problem and we are having it now, it is going to be the worst in my lifetime. It is a simple statement. The debt is much, much, much higher now. It has to be worse. We have these problems every few years. The next is going to be horrible.

The United States is spending trillions with the T and printing trillions of dollars; what do you mean nothing happened? The Bank of Japan, the guy goes to work, turns on the printing presses, print as fast as he can. All over the world, all these central banks and governments are printing and spending and borrowing as much as they can. Of course, the market is going up...

- Source, Economic Times

The United States is spending trillions with the T and printing trillions of dollars; what do you mean nothing happened? The Bank of Japan, the guy goes to work, turns on the printing presses, print as fast as he can. All over the world, all these central banks and governments are printing and spending and borrowing as much as they can. Of course, the market is going up...

- Source, Economic Times

Thursday, September 10, 2020

Friday, September 4, 2020

Monday, August 31, 2020

Jim Rogers Gives the Best Investing Advice You’ll Hear, Talks the Next Big Market Crash

Rogers draws on his decades-long investing experience, from his early days on Wall St. to his successes with the Quantum Fund, to give candid advice to any investor looking to win in the long haul.

- Source, Kitco News

Sunday, August 16, 2020

Jim Rogers: People Have No Idea How Bad the Coming Crisis is Going to Be

- Source, Life Success Story

Wednesday, August 12, 2020

Jim Rogers on How Gold, Silver and the US Dollar Are Going to Fare Moving Forward

Where is the US Dollar, gold, and silver headed given the expansive monetary policies aimed at combating virus-induced economic fallout?

Will the Euro move beyond its current problems in relation to the conflict between the ECB and Germany's Constitutional Court? And could Bitcoin gain some profile on the back of the Euro's problems?

Join us on this episode of Trading Global Markets Decoded to find out.

- Source, Daily FX

Friday, August 7, 2020

Jim Rogers: Bitcoin Needs to Remain Speculative

Since bitcoin’s initial inception in 2008, the currency has been pushed as a valid currency designed for purchasing goods and services. The asset was built to replace things like fiat and credit cards to give financial power and independence back to the people who would use it and remove themselves from the hands of the big banks that control the global financial system.

However, according to Rogers, if this ever did happen, bitcoin would be in serious trouble, as governments would work extra hard to eliminate it. He states:

"If the cryptocurrency succeeds as real money, rather than the subject of gambling as it is today, the government will make the cryptocurrency illegal and eliminate it."

One of the big problems that stems from bitcoin is that it seeks to make the financial world decentralized. This means no more banks, no more standard financial institutions; finance as we know it would completely disappear if bitcoin ever became completely mainstream. While this presents many benefits for the public, those running the banks see the currency as an enemy of their livelihoods. With bitcoin moving further up the financial ladder, these people stand to be out of job.

Right now, the asset is working primarily as a speculative asset. Those who choose to invest in it have an opportunity to see their wealth hedged against economic strife. In addition, they are adding to their portfolios and looking to potentially grow their wealth over time with the addition of a new asset.

Many companies aren’t allowing bitcoin to be used for purchasing goods and services given that it’s still very vulnerable to volatility and price swings, which scares businesses because they could lose money.

This could be something that’s working in bitcoin’s favor. The fact that many institutions still don’t view it as real money could be what ultimately keeps the coin in play. Over time, as its legitimacy is established, perhaps there will be greater use cases for the world’s number one cryptocurrency by market cap, but until then, Rogers feels bitcoin will be much safer as a low-key investment tool.

BTC as Real Money Is Dangerous

He states:

"The government likes electronic money because with electronic money, you can track when and where who spent what amount. Governments will have more control over people through electronic money. The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be erased… The government has something that those who work with virtual currencies don’t. It’s a gun."

However, according to Rogers, if this ever did happen, bitcoin would be in serious trouble, as governments would work extra hard to eliminate it. He states:

"If the cryptocurrency succeeds as real money, rather than the subject of gambling as it is today, the government will make the cryptocurrency illegal and eliminate it."

One of the big problems that stems from bitcoin is that it seeks to make the financial world decentralized. This means no more banks, no more standard financial institutions; finance as we know it would completely disappear if bitcoin ever became completely mainstream. While this presents many benefits for the public, those running the banks see the currency as an enemy of their livelihoods. With bitcoin moving further up the financial ladder, these people stand to be out of job.

Right now, the asset is working primarily as a speculative asset. Those who choose to invest in it have an opportunity to see their wealth hedged against economic strife. In addition, they are adding to their portfolios and looking to potentially grow their wealth over time with the addition of a new asset.

Many companies aren’t allowing bitcoin to be used for purchasing goods and services given that it’s still very vulnerable to volatility and price swings, which scares businesses because they could lose money.

This could be something that’s working in bitcoin’s favor. The fact that many institutions still don’t view it as real money could be what ultimately keeps the coin in play. Over time, as its legitimacy is established, perhaps there will be greater use cases for the world’s number one cryptocurrency by market cap, but until then, Rogers feels bitcoin will be much safer as a low-key investment tool.

BTC as Real Money Is Dangerous

He states:

"The government likes electronic money because with electronic money, you can track when and where who spent what amount. Governments will have more control over people through electronic money. The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be erased… The government has something that those who work with virtual currencies don’t. It’s a gun."

- Source, Live Bitcoin News

Sunday, August 2, 2020

Jim Rogers on US Economy, Gold, USD Amidst Pandemic

Talk begins on the US economy – and Jim’s outlook remains as bleak as at the time of the previous DailyFX Jim Rogers podcast in August 2019. “I told you last time – the next time the world has a problem it’s going to be the worst in my lifetime.

“It is the worst in my lifetime and the reason I said it was because there was so much debt [that had] built up in the world. In 2008 we had a big problem because of too much debt; since then the debt everywhere has skyrocketed, even in China.”

Jim points to nearly every government in the world having started printing and spending staggering amounts of money. “America was already the largest debtor nation in the world, and along came [coronavirus] and America has added trillions and printed trillions more. This is going to be a serious burden for the world economy.”

As Jim sees it, the ten-year bull run in US stocks also made a market slump overdue in addition to an economic slump, and coronavirus was just an excuse. “There would’ve been some reason. Some places were already slowing down, and along came the bubble and now we have the excuse. We always have an excuse and here it is.”

Gold, Silver, USD and Safe Havens: How Safe?

So, with this outlook, what does Jim have to say about the viability of gold, USD, and other assets traditionally viewed as safe havens? “I stopped buying gold and silver in 2010 and I started buying again last summer. I bought more recently and I will probably continue to buy both gold and silver; more silver than gold now because silver is down much more.”

On USD: “It’s not a safe haven, but [the important thing is] people think it is. I still own a lot of US Dollars and I haven’t sold any. It’s going to get overpriced and it could conceivably turn into a bubble, depending on how bad things get in the world.”

USD being Jim’s currency of choice is explained in part by the unattractiveness, as he sees it, of the alternatives. “Right now with the Euro, many people are skeptical. British Pound? Please. I love the UK, but that’s not even a semi-sound currency any more. The Swiss Franc is being so debased, and as for the Japanese Yen? Japan has staggering debts, with a population declining for ten years.

“[So] which currency? That’s part of the problem.”

“It is the worst in my lifetime and the reason I said it was because there was so much debt [that had] built up in the world. In 2008 we had a big problem because of too much debt; since then the debt everywhere has skyrocketed, even in China.”

Jim points to nearly every government in the world having started printing and spending staggering amounts of money. “America was already the largest debtor nation in the world, and along came [coronavirus] and America has added trillions and printed trillions more. This is going to be a serious burden for the world economy.”

As Jim sees it, the ten-year bull run in US stocks also made a market slump overdue in addition to an economic slump, and coronavirus was just an excuse. “There would’ve been some reason. Some places were already slowing down, and along came the bubble and now we have the excuse. We always have an excuse and here it is.”

Gold, Silver, USD and Safe Havens: How Safe?

So, with this outlook, what does Jim have to say about the viability of gold, USD, and other assets traditionally viewed as safe havens? “I stopped buying gold and silver in 2010 and I started buying again last summer. I bought more recently and I will probably continue to buy both gold and silver; more silver than gold now because silver is down much more.”

On USD: “It’s not a safe haven, but [the important thing is] people think it is. I still own a lot of US Dollars and I haven’t sold any. It’s going to get overpriced and it could conceivably turn into a bubble, depending on how bad things get in the world.”

USD being Jim’s currency of choice is explained in part by the unattractiveness, as he sees it, of the alternatives. “Right now with the Euro, many people are skeptical. British Pound? Please. I love the UK, but that’s not even a semi-sound currency any more. The Swiss Franc is being so debased, and as for the Japanese Yen? Japan has staggering debts, with a population declining for ten years.

“[So] which currency? That’s part of the problem.”

- Source, Daily FX, read more here

Tuesday, July 28, 2020

Governments Will Kill Crypto, Warns Jim Rogers

Bitcoin has made its fair share of enemies since it was created a little over 10 years ago, writes Forbes journalist Billy Bambrough.

The bitcoin price, soaring to around $20,000 per bitcoin in late 2017, thrust cryptocurrencies into the global limelight, prompting governments to clamp down on their use and companies such as Facebook to create their own.

Now, legendary investor Jim Rogers has warned bitcoin and similar “virtual currencies beyond the influence of the government” will not be allowed to survive – and said the bitcoin price is headed to zero.

“If the cryptocurrency succeeds as real money, rather than the subject of gambling as it is today, the government will make the cryptocurrency illegal and eliminate it,” Rogers told Japan’s Aera dot in comments translated by Google.

Rogers is perhaps best-known for co-founding the Quantum Fund with fellow legend George Soros and has gone on to establish himself as a television and media personality.

Bitcoin, still mostly used as an instrument of speculation, has attracted attention in recent months as the coronavirus pandemic has spread and governments have taken extreme action to support their economies.

The US has allocated almost $3 trillion for coronavirus-related economic aid and the Federal Reserve has pumped trillions of dollars into the US economy.

Renowned investors including Paul Tudor Jones, Dan Tapiero and Raoul Pal have identified bitcoin as a potential hedge against the inflation unprecedented central bank stimulus measures could bring, though bitcoin is still far from being used as “real money.” Some 11 million bitcoin, roughly 60% of the current minted supply, has sat dormant for a whole year, according to a recent research report published by Digital Asset Data—suggesting investors are “buying to hold.”

However, governments around the world, spurred on by China’s efforts to digitalize its yuan and Facebook’s plans for a bitcoin-inspired digital currency, have accelerated their efforts to take money and spending online. “The government likes electronic money,” Rogers said. “Because with electronic money, you can track when, where, who spent what amount. Governments will have more control over people through electronic money.”

“The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be erased.”

Many in the bitcoin community see cryptocurrencies as a way of resisting government overreach and some fear a proposed digital US dollar could hand more power to the state. Rogers’ comments could throw fuel on those fears. “The government has something that those who work with virtual currencies don’t have,” Rogers said. “It’s a gun.”

The bitcoin price, still highly volatile and prone to wild swings, is increasingly being watched by Wall Street as they launch bitcoin and cryptocurrency services and take on clients in the space.

The bitcoin price, soaring to around $20,000 per bitcoin in late 2017, thrust cryptocurrencies into the global limelight, prompting governments to clamp down on their use and companies such as Facebook to create their own.

Now, legendary investor Jim Rogers has warned bitcoin and similar “virtual currencies beyond the influence of the government” will not be allowed to survive – and said the bitcoin price is headed to zero.

“If the cryptocurrency succeeds as real money, rather than the subject of gambling as it is today, the government will make the cryptocurrency illegal and eliminate it,” Rogers told Japan’s Aera dot in comments translated by Google.

Rogers is perhaps best-known for co-founding the Quantum Fund with fellow legend George Soros and has gone on to establish himself as a television and media personality.

Bitcoin, still mostly used as an instrument of speculation, has attracted attention in recent months as the coronavirus pandemic has spread and governments have taken extreme action to support their economies.

The US has allocated almost $3 trillion for coronavirus-related economic aid and the Federal Reserve has pumped trillions of dollars into the US economy.

Renowned investors including Paul Tudor Jones, Dan Tapiero and Raoul Pal have identified bitcoin as a potential hedge against the inflation unprecedented central bank stimulus measures could bring, though bitcoin is still far from being used as “real money.” Some 11 million bitcoin, roughly 60% of the current minted supply, has sat dormant for a whole year, according to a recent research report published by Digital Asset Data—suggesting investors are “buying to hold.”

However, governments around the world, spurred on by China’s efforts to digitalize its yuan and Facebook’s plans for a bitcoin-inspired digital currency, have accelerated their efforts to take money and spending online. “The government likes electronic money,” Rogers said. “Because with electronic money, you can track when, where, who spent what amount. Governments will have more control over people through electronic money.”

“The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be erased.”

Many in the bitcoin community see cryptocurrencies as a way of resisting government overreach and some fear a proposed digital US dollar could hand more power to the state. Rogers’ comments could throw fuel on those fears. “The government has something that those who work with virtual currencies don’t have,” Rogers said. “It’s a gun.”

The bitcoin price, still highly volatile and prone to wild swings, is increasingly being watched by Wall Street as they launch bitcoin and cryptocurrency services and take on clients in the space.

- Source, Asia Times

Friday, July 24, 2020

A Market Forecast From Legendary Investor Jim Rogers

It may have already started,” renowned investor Jim Rogers said, while contemplating an impending market downturn. “It starts when people aren’t looking and it snowballs and builds up, and then, after a year or two, it's on the evening news.”

Although it wasn’t known at the time these predictions, spoken from his home in Singapore in January, would prove to be prophetic. The markets had been enjoying a record-breaking bull run for eleven years, but by March there was a sea of red across the screens of investors and traders.

The coronavirus pandemic sent markets in the US, Europe and Asia spiralling at speeds not seen since 2008.

But a shock like this isn’t anything new to Rogers. The stock market crash of 1987 happened on his birthday, after all.

Luckily for him, he had predicted a collapse was imminent, taking out short positions at the time. However, there was no way for him to know it would be so severe. It was “the best birthday” he ever had.

Bearing down

For the past few years, Rogers has been saying that the next time such a bear market occurs, the levels of debt are going to make for a very, very bad situation.

“In 2008, we had problems in the economy and in the markets because of too much debt. Since then, debt has skyrocketed all over the world,” he says. “What surprises me is that people don’t understand that, but to me, it’s very, very simple.”

At the time Opto went to press, many were warning of a global recession. Indeed, in an effort to temper a global economic collapse, central banks and governments had been spending and printing copious amounts of money.

While the potential impact of this turn of events may be alarming to some, Rogers remains calm. He is, after all, an expert at navigating market conditions like these. The key, he says, is not to listen to other people.

“In the 1930s, which is the most famous [economic downturn] in the past 100 years or so, a lot of people came out of that rich and built huge fortunes. But they were people who knew what they were doing and didn’t do other things, they just stayed with what they knew and became very successful,” Rogers says.

“What you really need to do when this bear market comes, is stay with what you know.”

Although it wasn’t known at the time these predictions, spoken from his home in Singapore in January, would prove to be prophetic. The markets had been enjoying a record-breaking bull run for eleven years, but by March there was a sea of red across the screens of investors and traders.

The coronavirus pandemic sent markets in the US, Europe and Asia spiralling at speeds not seen since 2008.

But a shock like this isn’t anything new to Rogers. The stock market crash of 1987 happened on his birthday, after all.

Luckily for him, he had predicted a collapse was imminent, taking out short positions at the time. However, there was no way for him to know it would be so severe. It was “the best birthday” he ever had.

Bearing down

For the past few years, Rogers has been saying that the next time such a bear market occurs, the levels of debt are going to make for a very, very bad situation.

“In 2008, we had problems in the economy and in the markets because of too much debt. Since then, debt has skyrocketed all over the world,” he says. “What surprises me is that people don’t understand that, but to me, it’s very, very simple.”

At the time Opto went to press, many were warning of a global recession. Indeed, in an effort to temper a global economic collapse, central banks and governments had been spending and printing copious amounts of money.

While the potential impact of this turn of events may be alarming to some, Rogers remains calm. He is, after all, an expert at navigating market conditions like these. The key, he says, is not to listen to other people.

“In the 1930s, which is the most famous [economic downturn] in the past 100 years or so, a lot of people came out of that rich and built huge fortunes. But they were people who knew what they were doing and didn’t do other things, they just stayed with what they knew and became very successful,” Rogers says.

“What you really need to do when this bear market comes, is stay with what you know.”

- Source, CMC Markets, read more here

Monday, July 6, 2020

Jim Rogers Discusses Bitcoin as Money and Why Governments Will Stop Crypto

Famous investor Jim Rogers shared his prediction about the future bitcoin and cryptocurrency in an interview with Asahi Shimbun Singapore branch manager Koji Nishimura, published on Friday. Rogers cofounded the Quantum Fund in 1973 with billionaire investor George Soros, which was considered one of the most successful hedge funds in its heyday. They earned a 4,200% return over 10 years through 1980 compared to 47% for the S&P 500.

Rogers believes that if cryptocurrency succeeds in being used as money, instead of primarily for speculation, governments will intervene, making it illegal in order to stop its use. For this reason, “I believe that the [value of] virtual currencies represented by bitcoin will decline and eventually become zero,” he told the publication. “It is hard for us to move money without the control of the government,” Rogers said, elaborating:

"The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be eliminated."

Rogers explained that cryptocurrency markets are volatile, particularly during the global economic crisis. “Even though cryptocurrencies did not even exist a few years ago, in the blink of an eye, they become 100 and 1,000 times more valuable … This is a clear bubble and I don’t know the right price,” he opined, emphasizing that cryptocurrency is not an investment but gambling.

He proceeded to talk about electronic money. “Governments like electronic money because with electronic money, you can keep track of when, where, who spent and how much. Governments will have more control over people through electronic money,” the investing guru described. “Electronic money has a low issuing cost. Cash must be printed, carried and counted. It is expensive for the government.”

However, cryptocurrencies beyond the control of governments will not be accepted as money, Rogers believes, adding that those who work on cryptocurrencies think they are “smarter than the government.” However, “the government has something that those who work with virtual currencies don’t have. It’s a gun.” For this reason, he said, “I believe that virtual currency will disappear eventually.”

He believes that governments will never let bitcoin be used as money. “Only 100 years ago, we could use whatever we liked as money. You could use coins, gold, silver, or shells. Banks could also print the bills themselves. That was legal,” he was quoted as saying. However, in the mid-1930s, the Bank of England declared that using any type of money other than the money it issued was illegal, Rogers pointed out. As a result, “no one used money other than that issued by the Bank of England,” he described, predicting that the same will happen to cryptocurrency.

While admitting that a society where governments “know too much about our actions” is “unfavorable,” he believes that cryptocurrency “beyond the control of the government will not be widely distributed as money.”

While Rogers is not bullish on cryptocurrency, many institutional investors are increasingly interested in investing in this asset class. Fidelity Digital Assets recently conducted a survey of about 800 institutional investors in Europe and the U.S. and found that 80% of them find cryptocurrency appealing, while 60% feel cryptocurrencies have a place in their portfolios. Grayscale Investments also sees increasing demand for crypto investments.

Well-known hedge fund managers such as Paul Tudor Jones have been growing their bitcoin holdings. Jones said he has about 2% of his assets in bitcoin. Other billionaire investors who are bullish on bitcoin include Virgin Galactic chairman Chamath Palihapitiya and Galaxy Digital CEO Mike Novogratz.

Rogers believes that if cryptocurrency succeeds in being used as money, instead of primarily for speculation, governments will intervene, making it illegal in order to stop its use. For this reason, “I believe that the [value of] virtual currencies represented by bitcoin will decline and eventually become zero,” he told the publication. “It is hard for us to move money without the control of the government,” Rogers said, elaborating:

"The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be eliminated."

Rogers explained that cryptocurrency markets are volatile, particularly during the global economic crisis. “Even though cryptocurrencies did not even exist a few years ago, in the blink of an eye, they become 100 and 1,000 times more valuable … This is a clear bubble and I don’t know the right price,” he opined, emphasizing that cryptocurrency is not an investment but gambling.

He proceeded to talk about electronic money. “Governments like electronic money because with electronic money, you can keep track of when, where, who spent and how much. Governments will have more control over people through electronic money,” the investing guru described. “Electronic money has a low issuing cost. Cash must be printed, carried and counted. It is expensive for the government.”

However, cryptocurrencies beyond the control of governments will not be accepted as money, Rogers believes, adding that those who work on cryptocurrencies think they are “smarter than the government.” However, “the government has something that those who work with virtual currencies don’t have. It’s a gun.” For this reason, he said, “I believe that virtual currency will disappear eventually.”

He believes that governments will never let bitcoin be used as money. “Only 100 years ago, we could use whatever we liked as money. You could use coins, gold, silver, or shells. Banks could also print the bills themselves. That was legal,” he was quoted as saying. However, in the mid-1930s, the Bank of England declared that using any type of money other than the money it issued was illegal, Rogers pointed out. As a result, “no one used money other than that issued by the Bank of England,” he described, predicting that the same will happen to cryptocurrency.

While admitting that a society where governments “know too much about our actions” is “unfavorable,” he believes that cryptocurrency “beyond the control of the government will not be widely distributed as money.”

While Rogers is not bullish on cryptocurrency, many institutional investors are increasingly interested in investing in this asset class. Fidelity Digital Assets recently conducted a survey of about 800 institutional investors in Europe and the U.S. and found that 80% of them find cryptocurrency appealing, while 60% feel cryptocurrencies have a place in their portfolios. Grayscale Investments also sees increasing demand for crypto investments.

Well-known hedge fund managers such as Paul Tudor Jones have been growing their bitcoin holdings. Jones said he has about 2% of his assets in bitcoin. Other billionaire investors who are bullish on bitcoin include Virgin Galactic chairman Chamath Palihapitiya and Galaxy Digital CEO Mike Novogratz.

- Source, Bitcoin News

Wednesday, July 1, 2020

There Will Soon be a Blow Up in US and Possibly Japanese Markets

What is happening to the world? Everybody is simply trying to use the word liquidity. When I ask experts why are markets going up when the world is looking bad, the simple answer is it is liquidity, it is Fed, it is money.

The main thing that is going on in the world is that central banks all over the world are printing huge amounts of money and governments are borrowing and spending huge amounts of money.Every day the Bank of Japan goes in there and starts printing money as fast as it can and is buying stocks, buying ETFs, buying bonds.

The main thing that is going on in the world is that central banks all over the world are printing huge amounts of money and governments are borrowing and spending huge amounts of money.Every day the Bank of Japan goes in there and starts printing money as fast as it can and is buying stocks, buying ETFs, buying bonds.

About somewhat the same is happening all over the world. In the US, they are not buying stocks. We do not think yet, but they are buying everything else. This is insane. But it is great for investors, it is great for stockbrokers, it is great for ETNow. Is it good for the world? No.

So if global central bankers are likely to print more money and if interest rates are likely to remain low, then what could be the end game for equities and for this so-called summer madness which we have seen in just about every asset class?

First you must remember that in America, there is an election in Nov. And in Washington, they are doing everything they can to get re-elected.

So if global central bankers are likely to print more money and if interest rates are likely to remain low, then what could be the end game for equities and for this so-called summer madness which we have seen in just about every asset class?

First you must remember that in America, there is an election in Nov. And in Washington, they are doing everything they can to get re-elected.

That is what they do. They do not care about us. They do not care about our children. They care about getting elected. So until November anyway, this is all going to continue in the US. But other places will probably follow too. The end game?

- Source, ET, read the full article here

Friday, June 26, 2020

Legendary Investor Jim Rogers Warns Governments Will Have To "Eliminate" Bitcoin

Bitcoin has made its fair share of enemies since it was created a little over ten years ago.

The bitcoin price, soaring to around $20,000 per bitcoin in late 2017, thrust cryptocurrencies into the global limelight, prompting governments to clamp down on their use and companies such as Facebook to create their own.

Now, legendary investor Jim Rogers has warned bitcoin and similar "virtual currencies beyond the influence of the government" will not be allowed to survive—and said the bitcoin price is headed to zero.

"If the cryptocurrency succeeds as real money, rather than the subject of gambling as it is today, the government will make the cryptocurrency illegal and eliminate it," Rogers told Japan's Aera dot in comments translated by Google.

Rogers is perhaps best-known for co-founding the Quantum Fund, with fellow legend George Soros and has gone on to establish himself as a television and media personality.

Bitcoin, still mostly used as an instrument of speculation, has attracted attention in recent months as the coronavirus pandemic has spread and governments have taken extreme action to support their economies.

The U.S. has allocated almost $3 trillion for coronavirus-related economic aid and the Federal Reserve has pumped trillions of dollars into the U.S. economy.

Renowned investors including Paul Tudor Jones, Dan Tapiero and Raoul Pal have named bitcoin as a potential hedge against the inflation unprecedented central bank stimulus measures could bring, though bitcoin is still far from being used as "real money." Some 11 million bitcoin, roughly 60% of the current minted supply, has sat dormant for a whole year, according to a recent research report published by Digital Asset Data—suggesting investors are "buying to hold."

However, governments around the world, spurred on by China's efforts to digitalize its yuan and Facebook's plans for a bitcoin-inspired digital currency, have accelerated their efforts to take money and spending online. "The government likes electronic money," Rogers said. "Because with electronic money, you can track when, where, who spent what amount. Governments will have more control over people through electronic money."

"The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be erased."

Many in the bitcoin community see cryptocurrencies as a way of resisting government overreach and some fear a proposed digital U.S. dollar could hand more power to the state. Rogers' comments could throw fuel on those fears. "The government has something that those who work with virtual currencies don't have," Rogers said. "It's a gun."

The bitcoin price, still highly volatile and prone to wild swings, is increasingly being watched by Wall Street as they launch bitcoin and cryptocurrency services and take on clients in the space.

The bitcoin price, soaring to around $20,000 per bitcoin in late 2017, thrust cryptocurrencies into the global limelight, prompting governments to clamp down on their use and companies such as Facebook to create their own.

Now, legendary investor Jim Rogers has warned bitcoin and similar "virtual currencies beyond the influence of the government" will not be allowed to survive—and said the bitcoin price is headed to zero.

"If the cryptocurrency succeeds as real money, rather than the subject of gambling as it is today, the government will make the cryptocurrency illegal and eliminate it," Rogers told Japan's Aera dot in comments translated by Google.

Rogers is perhaps best-known for co-founding the Quantum Fund, with fellow legend George Soros and has gone on to establish himself as a television and media personality.

Bitcoin, still mostly used as an instrument of speculation, has attracted attention in recent months as the coronavirus pandemic has spread and governments have taken extreme action to support their economies.

The U.S. has allocated almost $3 trillion for coronavirus-related economic aid and the Federal Reserve has pumped trillions of dollars into the U.S. economy.

Renowned investors including Paul Tudor Jones, Dan Tapiero and Raoul Pal have named bitcoin as a potential hedge against the inflation unprecedented central bank stimulus measures could bring, though bitcoin is still far from being used as "real money." Some 11 million bitcoin, roughly 60% of the current minted supply, has sat dormant for a whole year, according to a recent research report published by Digital Asset Data—suggesting investors are "buying to hold."

However, governments around the world, spurred on by China's efforts to digitalize its yuan and Facebook's plans for a bitcoin-inspired digital currency, have accelerated their efforts to take money and spending online. "The government likes electronic money," Rogers said. "Because with electronic money, you can track when, where, who spent what amount. Governments will have more control over people through electronic money."

"The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be erased."

Many in the bitcoin community see cryptocurrencies as a way of resisting government overreach and some fear a proposed digital U.S. dollar could hand more power to the state. Rogers' comments could throw fuel on those fears. "The government has something that those who work with virtual currencies don't have," Rogers said. "It's a gun."

The bitcoin price, still highly volatile and prone to wild swings, is increasingly being watched by Wall Street as they launch bitcoin and cryptocurrency services and take on clients in the space.

- Source, Forbes

Friday, June 12, 2020

One For The Ages

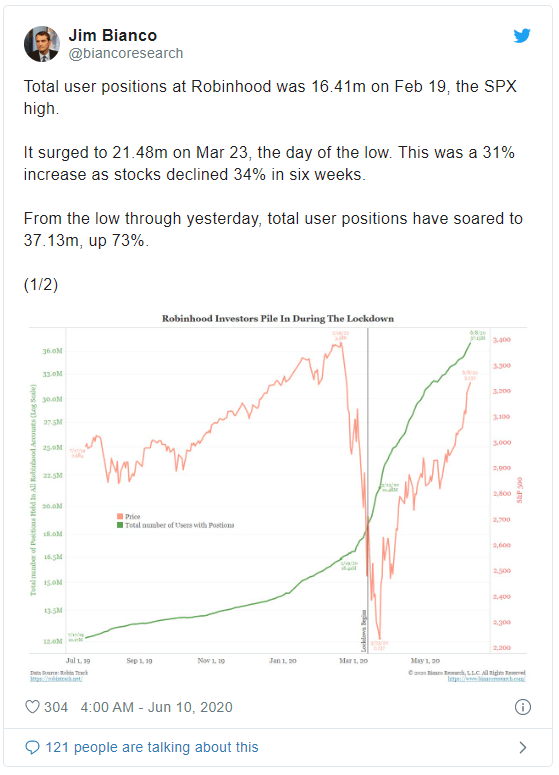

I do a good deal of reading every day and I share the best of what I find on Twitter. The purpose of this reading is not so much to find out what's really going on as it is to try to understand how people feel about what is going on. What are the trends and narratives that are important to market participants and where are they in their life cycle.

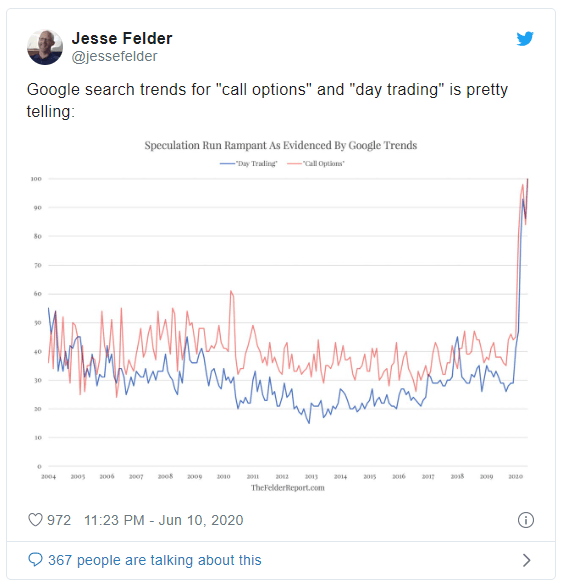

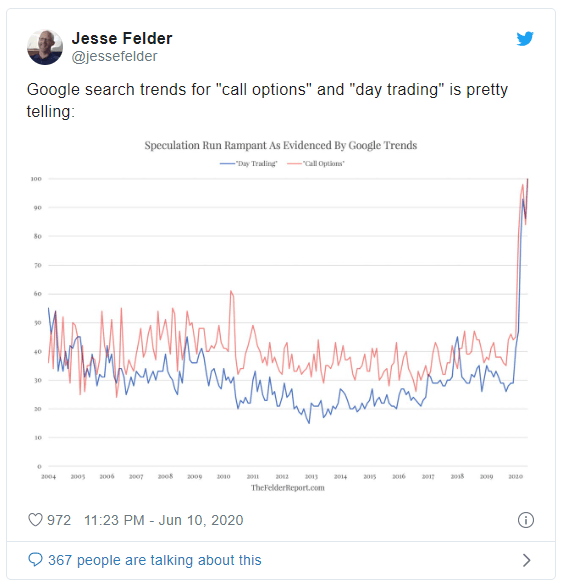

One trend I've been following for a while now is the growing participation in the financial markets on the part of young individuals. Since most brokers went commission-free, following in Robinhood's footsteps, the interest in trading has gone through the roof. This week feels like the narrative is reaching a crescendo.

So I thought it might be important to immortalize some of the stories in my recent Twitter feed in a blog post here. During the dotcom mania, my friend Bill Fleckenstein tracked the bubble in what he called, "The Mania Chronicles." Consider this my very limited version of the same.

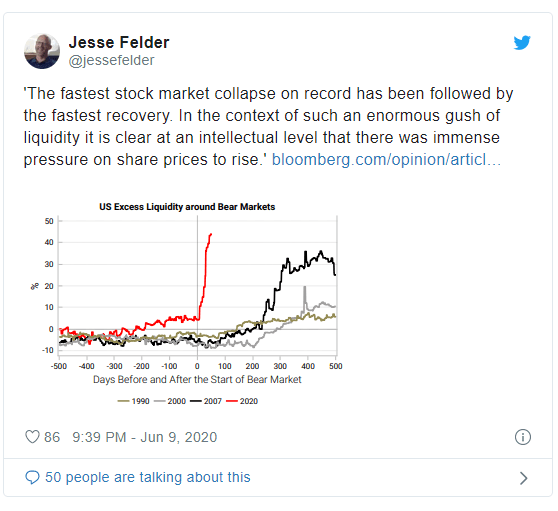

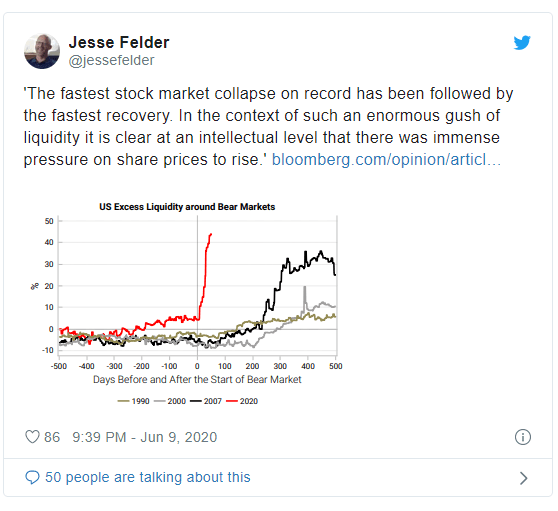

The stock market has set many records this year. After putting in the fastest 10% decline from a new high, it then put in the fastest 20% and 30% declines. Since then, however, it's now put in the fastest recovery from a crash in history.

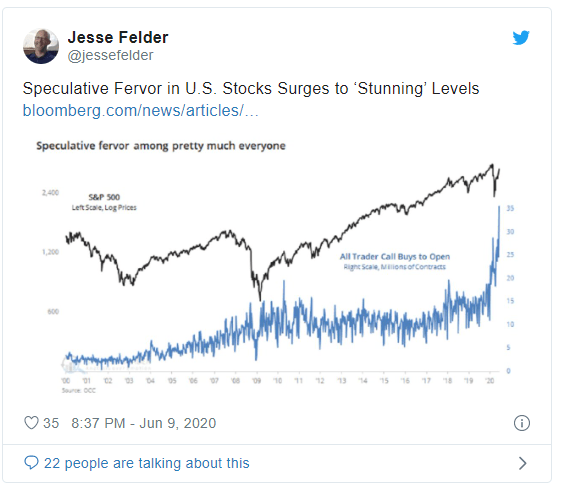

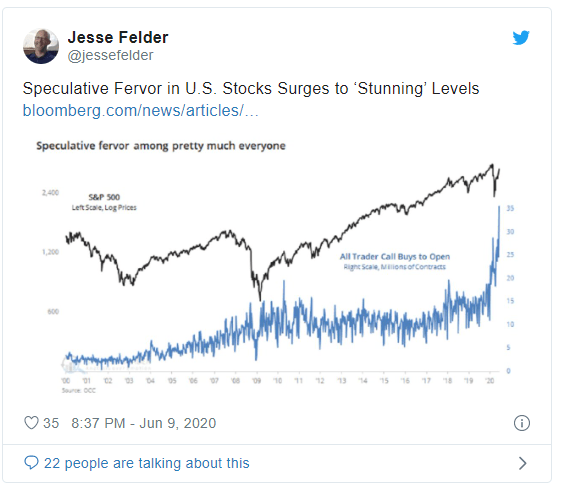

An unprecedented boom in money printing for the explicit purpose of supporting asset prices is certainly part of the reason for the recovery but it is also important to note what that money printing has inspired: an unprecedented boom in financial market speculation by retail traders.

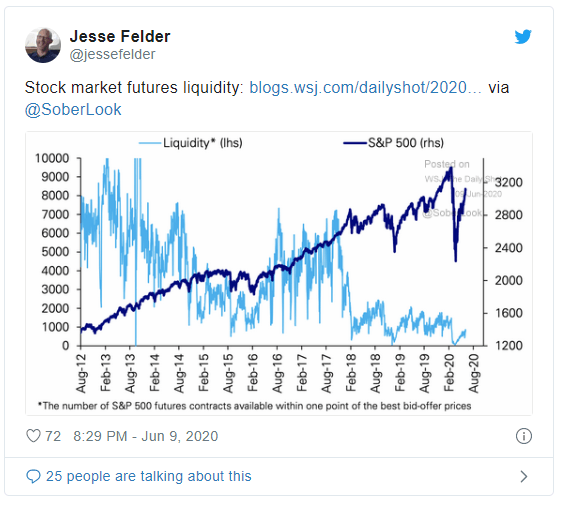

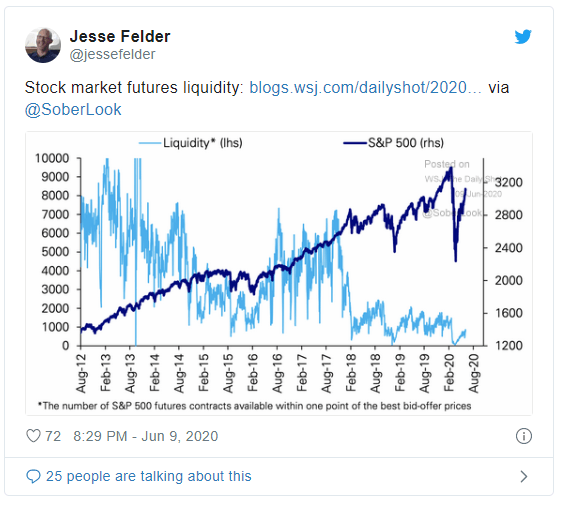

Combine massive money printing with mass speculation and record low liquidity (in futures and almost every other market) and you get the fastest 50-day rise in the stock market on record.

As a result, we now have an army of traders who believe they are the second coming of Warren Buffett. While the Oracle of Omaha now looks foolish for selling his airline stocks, those who bought them up over the past few months are gloating like you rarely see in this game.

Like Mark Cuban said, "everybody is a genius in a bull market," and the largest 50-day gain in history is minting a ton of geniuses right now.

To get a sense of the mindset of many of these traders, the Wall Street Journal spoke to a few of them and they make no bones about gambling with the funds the government sent them as part of the CARES Act, trying to double or triple it in just a day's time.

In 1999 and 2000, day traders went for the hottest internet stocks of the day in trying to make outsized returns; eventually many went bankrupt. Today, they're looking for outsized returns in the stocks that have already filed for bankruptcy protection!

But if there's a lesson from that earlier period, it's this:

This rally has humbled not only Warren Buffett but also Stan Druckenmiller, Sam Zell, Carl Icahn, Paul Singer, Jim Rogers and a host of other true geniuses of the industry whom have bet against it. It seems like it may soon be time for it to carry out those betting with it.

One trend I've been following for a while now is the growing participation in the financial markets on the part of young individuals. Since most brokers went commission-free, following in Robinhood's footsteps, the interest in trading has gone through the roof. This week feels like the narrative is reaching a crescendo.

So I thought it might be important to immortalize some of the stories in my recent Twitter feed in a blog post here. During the dotcom mania, my friend Bill Fleckenstein tracked the bubble in what he called, "The Mania Chronicles." Consider this my very limited version of the same.

The stock market has set many records this year. After putting in the fastest 10% decline from a new high, it then put in the fastest 20% and 30% declines. Since then, however, it's now put in the fastest recovery from a crash in history.

An unprecedented boom in money printing for the explicit purpose of supporting asset prices is certainly part of the reason for the recovery but it is also important to note what that money printing has inspired: an unprecedented boom in financial market speculation by retail traders.

Combine massive money printing with mass speculation and record low liquidity (in futures and almost every other market) and you get the fastest 50-day rise in the stock market on record.

As a result, we now have an army of traders who believe they are the second coming of Warren Buffett. While the Oracle of Omaha now looks foolish for selling his airline stocks, those who bought them up over the past few months are gloating like you rarely see in this game.

Like Mark Cuban said, "everybody is a genius in a bull market," and the largest 50-day gain in history is minting a ton of geniuses right now.

To get a sense of the mindset of many of these traders, the Wall Street Journal spoke to a few of them and they make no bones about gambling with the funds the government sent them as part of the CARES Act, trying to double or triple it in just a day's time.

In 1999 and 2000, day traders went for the hottest internet stocks of the day in trying to make outsized returns; eventually many went bankrupt. Today, they're looking for outsized returns in the stocks that have already filed for bankruptcy protection!

But if there's a lesson from that earlier period, it's this:

This rally has humbled not only Warren Buffett but also Stan Druckenmiller, Sam Zell, Carl Icahn, Paul Singer, Jim Rogers and a host of other true geniuses of the industry whom have bet against it. It seems like it may soon be time for it to carry out those betting with it.

- Source, Seeking Alpha

Tuesday, May 26, 2020

Jim Rogers: Petrol is Not Going to Stay Dirt Cheap for Five Years, Opportunities Exist

"They have to look at the same factors – supply and demand. If we look at energy, for instance, known reserves of oil have been declining for years. And then along came fracking. Fracking was a miracle, but fracking turned into a bubble. If you could spell fracking, people would give you money to invest. Now, fracking is not going to disappear. It’s going to disappear for a lot of people because some are going bankrupt. But fracking is still going to be around, but it’s not a bubble anymore. And they have to worry about supply and demand like everybody else.

Sugar is down something like 75% or 80% percent from its all-time high. I don’t know many things that are down 75% or 80% percent from their all-time high. So all commodities dealers, producers and consumers are going to have to worry now about supply and demand. Most consumers are going to be better off if you are asking about the next year or two, except [those exposed to] gold. So most people are getting a benefit from this collapse, at least in their cost of living, if they have a job.

But now we all have to start worrying, including producers and consumers, about supply and demand because the price of most commodities are not going to stay down here where they are. I don’t think petrol is going to stay dirt cheap for the next five years, because production is starting to decline. So the answer is simple – supply and demand."

Sugar is down something like 75% or 80% percent from its all-time high. I don’t know many things that are down 75% or 80% percent from their all-time high. So all commodities dealers, producers and consumers are going to have to worry now about supply and demand. Most consumers are going to be better off if you are asking about the next year or two, except [those exposed to] gold. So most people are getting a benefit from this collapse, at least in their cost of living, if they have a job.

But now we all have to start worrying, including producers and consumers, about supply and demand because the price of most commodities are not going to stay down here where they are. I don’t think petrol is going to stay dirt cheap for the next five years, because production is starting to decline. So the answer is simple – supply and demand."

- Source, SPGlobal

Friday, May 22, 2020

Jim Rogers: Bright Spots for Commodities, Risk Still Remain

In commodity and energy markets, who do you think will be at the winning end and the losing end? And in this scenario, is there such a thing as safe haven?

At the moment, nearly all commodities are touching lows. Anybody who has anything to do with commodities – unless they’ve sold them short or unless they use commodities, are losers, except gold. But everybody who uses oil is a winner right now – Germany, China, Japan. People who consume oil think this is heaven. They think they’ve won the jackpot. Gold is up over the past seven or eight years. This is higher now than it was since 2011. So every commodity user is benefiting right now.

How do you see commodity markets panning out for the rest of 2020 and in early 2021?

I would suspect that most commodities now are close to the bottom. We’re in a period where the cure for low prices is low prices. In other words, when prices get very low, people use more of it and the producer produces less. China has opened up. Other countries are opening up again. So demand will go up again and prices will go up again. As I look around the world and all asset classes, the cheapest asset class I can see right now are commodities. Certainly not bonds – bonds are in a bubble. Most currencies are certainly not overpriced but certainly not as cheap as they might be. Stocks are certainly not dirt cheap anywhere. Everything I see that’s historically very cheap – that’s commodities.

S&P Global Ratings has said that the coronavirus pandemic is dragging the global economy into a recession. How long do you think it might take us to get out of it?

The last time I spoke with Platts, I said that the next time we have an economic problem in the world, it would be the worst in my lifetime. And it is – here it is. It’s not over yet. It’s going to get worse before it’s over.

At the moment, nearly all commodities are touching lows. Anybody who has anything to do with commodities – unless they’ve sold them short or unless they use commodities, are losers, except gold. But everybody who uses oil is a winner right now – Germany, China, Japan. People who consume oil think this is heaven. They think they’ve won the jackpot. Gold is up over the past seven or eight years. This is higher now than it was since 2011. So every commodity user is benefiting right now.

How do you see commodity markets panning out for the rest of 2020 and in early 2021?

I would suspect that most commodities now are close to the bottom. We’re in a period where the cure for low prices is low prices. In other words, when prices get very low, people use more of it and the producer produces less. China has opened up. Other countries are opening up again. So demand will go up again and prices will go up again. As I look around the world and all asset classes, the cheapest asset class I can see right now are commodities. Certainly not bonds – bonds are in a bubble. Most currencies are certainly not overpriced but certainly not as cheap as they might be. Stocks are certainly not dirt cheap anywhere. Everything I see that’s historically very cheap – that’s commodities.

S&P Global Ratings has said that the coronavirus pandemic is dragging the global economy into a recession. How long do you think it might take us to get out of it?

The last time I spoke with Platts, I said that the next time we have an economic problem in the world, it would be the worst in my lifetime. And it is – here it is. It’s not over yet. It’s going to get worse before it’s over.

There’s going to be some rallies. But there’s too much debt. America was the largest debtor nation in the history of the world. And in the last month, Americans added several trillion – trillion with a T – dollars of debt and printed huge amounts of money. So the damage which is being done is going to take a while for people to recover from. There’s an election in November.

They all want to be elected in November. All they care about is getting elected. But in the future, America’s got a problem of gigantic debt, not just at the national level, but also at the level of states, cities, as well and individuals.

This is going to take a long time. In 1920, Great Britain was the richest, most powerful country in the world. But they started spending money and borrowing – doing the things that America is doing now.

They lost. I live in Singapore. Many companies in Singapore are going bankrupt. This is going to leave a lot of scars and a lot of damage.

- Source, SPGlobal

Thursday, May 21, 2020

Jim Rogers: Crude Crash Like Never Before

Last night's WTI crash was an aberration, Oil Prices cannot remain at zero. It was due to contract expiry, says Jim Rogers.

- Source, ET Now

Sunday, May 17, 2020

Jim Rogers Helps Decode the Inflation vs Deflation Debate

Jim Rogers is well known for thinking outside the box to find huge returns in markets all over the world.

But the same strategies that have made Jim Rogers famous can also improve your skills if you know how to apply them.

- Source, George Gammon

Tuesday, May 12, 2020

Jim Rogers Reveals Secrets That Could Make You Rich in This Crisis

Jim Rogers has beat the markets by looking for asymmetric bets, in areas and assets classes that are beaten down and extremely cheap. He tries to find a catalyst for change and looks to fade hysteria in markets.

By executing this strategy successfully for decades Jim Rogers has become one of the greats. And now Jim Rogers shares his wealth of knowledge with all of us.

- Source, George Gammon

Friday, May 8, 2020

Jim Rogers: Stock Up on Gold and Silver Before the Virus Crisis is Over

- Source, ET

Friday, May 1, 2020

Jim Rogers Expects to See "L-shaped" Recovery

The financial commentator based in Singapore said that the economic recovery would not be a V-shaped curve, which will see a steep upturn, or U-shaped one, which is marked by a slow upswing.

Instead, he projected the world would see an L-shaped curve because the “debt-based bubble has popped” to cause “the worst economy in his lifetime.” It is the worst-case scenario that is feared to bring about an extended recession.

“The economy is different from the market. The market is having a nice recovery now. The government is everywhere, spending a huge amount of money, printing a huge amount of money. We are having a market recovery by money printed and spent,” he said in a telephone interview.

“That is not the economy. The economy has problems and will continue to have problems for some time _ L-shape if I have to say something.”

But Rogers is looking for investment opportunities even during the economic downturn in such segments as “transportation, tourism, travel, hotel, and restaurants.”

“They have been beaten, they have been smashed. So that is where I found opportunities all over the world,” he said.

In South Korea, Rogers fixes his eyes on companies, which will benefit after the opening of the 38th Parallel, which has divided the two Koreas over the past 70 years.

“I expect that the 38th Parallel will open before too much longer, and when that does, some companies will do very well,” he said.

“Once the 38th Parallel opens, the (Korea) Peninsula will be very, very exciting. In fact, China is the most exciting country for the next century, but for the next decade or two, it would be Korea.”

The interview took place on April 20 before the April 21 news articles that North Korean leader Kim Jong-un might be in a “grave danger” after going through a previous surgery.

- Source, Korea News Plus

Tuesday, April 28, 2020

Jim Rogers is bullish on agriculture, gold, and silver

Jim Rogers, the legendary investor famous for co-founding the Quantum Fund with George Soros, dwelt on COVID-19, QE, and commodities on a call co-promoted by ETF Strategy.

The event coincided with the relisting of the Market Access Rogers International Commodity Index UCITS ETF (LON: RICI) on the London Stock Exchange.

The ETF returns to London after a hiatus of four years. China Post Global had canceled the ETF’s LSE listing in 2016 due to low trading volume.

“Interest in gold and commodities has increased sharply since the COVID-19 pandemic began,” explained Danny Dolan, Managing Director of China Post Global. “Investors are seeking a safe haven in gold, and an inflation hedge in broad commodity indices after huge quantitative easing measures.”

Jim Rogers designed the Rogers International Commodity Index (RICI) in 1996/97.

Here are his views on the virus, helicopter stimulus and commodities.

On COVID-19

Rogers noted the extremely adverse impact of COVID-19 on global economies, saying it was unparalleled since the days of the Depression.

Encouragingly, he thinks this is likely only to be temporary, and that the world will bounce back.

He also made the important qualification that though production will rebound, it may not recover to pre-virus levels for quite a while.

Quantitative easing and stimulus

However, it appears that Rogers is more worried about the debasement of the global financial system that started after the 2008 crisis through fiscal and monetary stimulus measures by countries around the world.

Rogers is alarmed that what was then admittedly an “experiment” is continuing due to short-sighted political motivations, with no thought for long-term implications.

He claimed that artificially induced, low interest rates had fuelled hugely leveraged bets by sovereigns and corporates. These positions could unwind with dire consequences including insolvencies and people’s loss of confidence in the financial system.

The event coincided with the relisting of the Market Access Rogers International Commodity Index UCITS ETF (LON: RICI) on the London Stock Exchange.

The ETF returns to London after a hiatus of four years. China Post Global had canceled the ETF’s LSE listing in 2016 due to low trading volume.

“Interest in gold and commodities has increased sharply since the COVID-19 pandemic began,” explained Danny Dolan, Managing Director of China Post Global. “Investors are seeking a safe haven in gold, and an inflation hedge in broad commodity indices after huge quantitative easing measures.”

Jim Rogers designed the Rogers International Commodity Index (RICI) in 1996/97.

Here are his views on the virus, helicopter stimulus and commodities.

On COVID-19

Rogers noted the extremely adverse impact of COVID-19 on global economies, saying it was unparalleled since the days of the Depression.

Encouragingly, he thinks this is likely only to be temporary, and that the world will bounce back.

He also made the important qualification that though production will rebound, it may not recover to pre-virus levels for quite a while.

Quantitative easing and stimulus

However, it appears that Rogers is more worried about the debasement of the global financial system that started after the 2008 crisis through fiscal and monetary stimulus measures by countries around the world.

Rogers is alarmed that what was then admittedly an “experiment” is continuing due to short-sighted political motivations, with no thought for long-term implications.

He claimed that artificially induced, low interest rates had fuelled hugely leveraged bets by sovereigns and corporates. These positions could unwind with dire consequences including insolvencies and people’s loss of confidence in the financial system.

- Source, invezz.com

Friday, April 24, 2020

Legendary investor Jim Rogers is long on the dollar in the short-term, and is buying more silver than gold

It’s an interesting dynamic we’re seeing in the currency markets at the moment: the Fed is pledging to print trillions of new dollars, and yet the value of the dollar itself is holding up remarkably well against the basket of currencies it’s usually measured against.

Of course, this is in part because other central banks are printing money too and so the effects of greater amounts of fiat currency all around cancel each other out, but it’s also because the dollar is considered the world’s safe-haven currency, the go-to cash denomination in times of stress.

It’s on that basis that legendary investor Jim Rogers, the originator of the Rogers International Commodity Index, is holding dollars, at least for now.

He might not hold them for long though, judging by the comments he made recently in a webinar hosted by NTree.

In the opening remarks of a short exposition about the current opportunities in commodities markets, Rogers pointed out that yields on 30-Year treasuries are trading at all-time lows, as demand for long-dated US-dollar denominated debt continues as part of a wider flight into bonds. How long that dynamic will last though, remains open to question.

“The dollar is not a safe-have,” said Rogers. “The US is the biggest debtor in the history of the world.”

So far, the edifice remains intact, but with the huge new debts being matched for size only by the huge money printing operation, it’s only a matter of time.

“Eventually people are going to say we are not going to take this garbage any more,” Rogers added0.

“And we will resume a recession. Huge damage is being done. Huge debts at the induvial as well as the government level are being built up and we’re all going to have to pay the price.”

Rogers is well aware that modern monetary theory allows for a controlled amount of money printing, but he is dismissive of the validity of the theory per se, the attractions of which he likens to Marxism in terms both of its appeal and of the illusory nature of its prescriptions.

“Printing money has never been bad for stocks and bonds but it does affect the price of real goods,” he says. “So I expect the rally to continue but eventually it will end and we’ll get new lows.”

What is the canny investor supposed to make of this new and frightening dynamic?

Rogers is clear enough.

“Last year I started to buy gold and silver,” he says. “I continue to buy gold and silver, and of the two I’m buying more silver now than gold because on a historic basis it’s much cheaper. Silver is down 80% or 70% from its all-time high if you go back, but gold is near its all-time high. One reason for that is that silver has more commercial and industrial uses than gold does. But when push comes to shove, if you ask me, I am buying more silver than gold.”

But gold itself is still very much on the Rogers menu too.

“I fully expect gold will make new highs before this is all over,” he adds.

“I expect the worst bear market in my lifetime, which might make gold go down, except for the fact I expect people to lose confidence in many governments around the world and in many currencies. And throughout history whenever people lose confidence in governments or money, they have always bought gold and silver. If any academics say you shouldn’t it doesn’t matter. All of us peasants have been buying gold and I am just a peasant like everybody else.”

Rogers’s commodity index isn’t itself that heavily weighted to gold and silver though, given that it also encompasses agricultural commodities and the oil and gas complex. Even so, it has managed to outperform other commodity indexes, largely because of the international focus of its constituent base, where other indices tend to have a bias towards the US consumer.

Of course, this is in part because other central banks are printing money too and so the effects of greater amounts of fiat currency all around cancel each other out, but it’s also because the dollar is considered the world’s safe-haven currency, the go-to cash denomination in times of stress.

It’s on that basis that legendary investor Jim Rogers, the originator of the Rogers International Commodity Index, is holding dollars, at least for now.

He might not hold them for long though, judging by the comments he made recently in a webinar hosted by NTree.

In the opening remarks of a short exposition about the current opportunities in commodities markets, Rogers pointed out that yields on 30-Year treasuries are trading at all-time lows, as demand for long-dated US-dollar denominated debt continues as part of a wider flight into bonds. How long that dynamic will last though, remains open to question.

“The dollar is not a safe-have,” said Rogers. “The US is the biggest debtor in the history of the world.”

So far, the edifice remains intact, but with the huge new debts being matched for size only by the huge money printing operation, it’s only a matter of time.

“Eventually people are going to say we are not going to take this garbage any more,” Rogers added0.

“And we will resume a recession. Huge damage is being done. Huge debts at the induvial as well as the government level are being built up and we’re all going to have to pay the price.”

Rogers is well aware that modern monetary theory allows for a controlled amount of money printing, but he is dismissive of the validity of the theory per se, the attractions of which he likens to Marxism in terms both of its appeal and of the illusory nature of its prescriptions.

“Printing money has never been bad for stocks and bonds but it does affect the price of real goods,” he says. “So I expect the rally to continue but eventually it will end and we’ll get new lows.”

What is the canny investor supposed to make of this new and frightening dynamic?

Rogers is clear enough.

“Last year I started to buy gold and silver,” he says. “I continue to buy gold and silver, and of the two I’m buying more silver now than gold because on a historic basis it’s much cheaper. Silver is down 80% or 70% from its all-time high if you go back, but gold is near its all-time high. One reason for that is that silver has more commercial and industrial uses than gold does. But when push comes to shove, if you ask me, I am buying more silver than gold.”

But gold itself is still very much on the Rogers menu too.

“I fully expect gold will make new highs before this is all over,” he adds.

“I expect the worst bear market in my lifetime, which might make gold go down, except for the fact I expect people to lose confidence in many governments around the world and in many currencies. And throughout history whenever people lose confidence in governments or money, they have always bought gold and silver. If any academics say you shouldn’t it doesn’t matter. All of us peasants have been buying gold and I am just a peasant like everybody else.”

Rogers’s commodity index isn’t itself that heavily weighted to gold and silver though, given that it also encompasses agricultural commodities and the oil and gas complex. Even so, it has managed to outperform other commodity indexes, largely because of the international focus of its constituent base, where other indices tend to have a bias towards the US consumer.

- Source, Proactive Investors

Monday, April 20, 2020

Jim Rogers: China On the Rise and Plans to Eclipse the United States

- Source, Silver Bullion TV

Tuesday, April 14, 2020

Friday, April 10, 2020

Jim Rogers: Markets Overbought, Debt is Skyrocking, US Dollar Bubble, Bitcoin Will Disappear

"No question that markets were overbought before“, says Jim Rogers (77). The American investor thinks: “The debt is skyrocking in the end. I can't think of a single central bank that is completely independent.“ Will our currencies survive?

"Not as we know them now. Certainly not the euro. The US dollar will go much higher. Turning to a bubble.“ And Bitcoin? "That will go to zero. All of those cyber currencies will disappear.“

- Source

Friday, April 3, 2020

Jim Rogers: More Central Bank Money Printing Will Result in a Huge Bubble in 2 Years

If you ask me today, I would say we would make new highs in the US stock market. Now I use that since it is the largest and most important stock market. I would suspect we would see new highs. We may even have a blow-off bubble. It has been a while since we have had a blow-off bubble in any stock market in the world.

So it may turn into a bubble. I do expect at least new highs before the whole thing collapses. But I want to tell you again, this is not good for any of us in the long run. In the long run, when this comes to an end, we are going to have the worst financial markets in my life time. I know I am older than you, so it is going to be the worst in your lifetime too.

In 2008, we had a big problem because of too much debt all over the world. Since 2008, debt has risen higher and higher and higher everywhere. Even China has a lot of debt now. In 2008, China had a lot of money saved for rainy days. It started raining and China started spending the money.

They helped save the world, but even China has a lot of debt now. In Germany, of all places, everybody has a lot of debt now. So next time around – I know some people would say we are never going to have a bear market again – but if you believe them. you should not listen to me.

I know we will have a bear market again, and I know the next one is going to be very-very bad. And when I say very bad, markets will go down 50-60-80, but some stocks will go down 80-90%. That is what bear markets do.

I am not trying to spread fear, I am just telling you how markets work. Do not listen to me, look it up. Bear markets always work that way.

- Source, Economic Times

Monday, March 30, 2020

Jim Rogers: We’re headed for the worst financial crisis of our lifetimes

Many people are going to suffer very badly, as the effects of this pandemic are going to last for a long time, according to Rogers.

“I told RT earlier that the next time we are going to have a financial problem it’s going to be the worst…” said Rogers, adding that it appears we are headed toward “the worst financial crisis of our lifetimes” and “we will know in a few months.”

According to the legendary investor, lots of industries like airlines and travel are going to suffer. Companies with big debts are especially vulnerable at this time, Rogers explained, and those participating in international trade in particular will have serious problems. “Some of them will be bankrupt,” he said, noting that major airlines and shipping companies will probably be bailed out because it would otherwise be “embarrassing for the countries.”

Talking about the financial markets’ turmoil, Rogers said, that most markets were not ready for the global health crisis and did not know what was coming. However, the reason behind such a mayhem is “not just the virus, it is certainly much more” than that.

Rogers also has a piece of advice for investors, suggesting they invest their money “only in what they know a lot about.”

- Source, Russia Today

Thursday, March 26, 2020

Monday, March 23, 2020

Coronavirus gold market meltdown, Jim Rogers says keep your money safe here

The Dow Jones Industrial Average dropped 900 points, or more than 3%, and traded below 25,000. The S&P 500 slid 2.6% and gold futures were in freefall heading into the weekend, down close to 3.5% on the day, last trading at $1,583.90 an ounce. Rogers comments on where to keep your money safe.

- Source, Kitco News

Saturday, March 7, 2020

Coronavirus impact not fully priced in, says Rogers Holdings chairman

"The global financial markets, including India, have been taken aback by the rampant spreading of coronavirus and its possible adverse effects on economic growth. Jim Rogers, chairman of Rogers Holdings, tells Puneet Wadhwa that he is looking to invest in India upon a correction.

He also wants the Indian government to do away with protectionist regulations. Edited excerpts: How do you see the global financial markets play out in the backdrop ofcoronavirus fears? The virus is slowing down the global economy. Airports, hotels and other public places across the globe have very few ... "

He also wants the Indian government to do away with protectionist regulations. Edited excerpts: How do you see the global financial markets play out in the backdrop of

- Source, Business Standard

Tuesday, March 3, 2020

Jim Rogers: Coronavirus = Opportunity: Gold, Stocks, Agriculture, China, Korea, Russia

- Source

Saturday, February 29, 2020

Long-term repo funds: Dress rehearsal before a bigger play?

"Since Adam Smith, economists have generally believed in the capacity of free markets to allocate resources efficiently. But most of my colleagues and I recognised that, in a financial panic, fear and risk aversion prevent financial markets from serving their critical functions. For now our interventions remained essential, I argued," wrote Ben Bernanke in his memoirs.

When the Federal Reserve explored for ammunition in its arsenal beyond conventional tools during the global financial crisis, many like Jim Rogers who relied on conventional economics believed there wasn’t much at the central bank’s disposal. It was doom’s day. But the late Martin Zweig’s ‘Don’t fight the Fed’ adage gained currency as easy policies rolled on.

Central banks in the developed world resorted to many actions, one after the other, to prevent another Great Depression. From cutting interest rates to zero, to buying unlimited quantities of bonds — treasuries to mortgages — in unconventional monetary policy (UMP). More was in store whenever markets turned wobbly. Negative interest rates to buying corporate bonds which were part of academic research turned into reality.

UMP for India was not on the agenda because India couldn’t afford it as it had its own problems in high inflation, a soaring fiscal deficit and a ballooning current account deficit. So Indian monetary policy moved in the opposite direction.

But Reserve Bank of India governor Shaktikanta Das last week wore the hat of former ECB president Mario Draghi when he came up with long-term repo funding of Rs 1 lakh crore though there is no apparent financial panic.

Financial institutions may not be on the brink like they were on Wall Street in 2008, but the credit market is seized up, but for the top-rated ones. Loans are growing at an anaemic 7.1 per cent despite 135 basis points of cut in the key lending rate by the RBI, reflecting bankers’ risk aversion. The longterm repo option is aimed at credit flow to Main Street. A basis point is 0.01 percentage point.

Banks bidding for Rs 1.9 lakh crore at Monday’s auction when Rs 25,000 crore was on offer is a sign that the RBI nudge is beginning to work.

This not only brings down the yields market, for some banks, even internally this is beneficial. Many global banks that offer clients hedging facilities have ‘liquidity charge’ of 30 to 40 basis points on their bonds and derivatives desk which could vanish with this facility.

While the initial adjustments in short-term rates have happened, it needs sustained efforts to make bank loans cheaper and available for a wider universe. Furthermore, it is a question of confidence and capital at the financial institutions.

Here the RBI lends against sovereign paper, that too with a 5 per cent haircut for possible mark-to-market value erosion. It could next move to triple A paper, and extend to lesser rated ones, probably with a 35-40 per cent haircut.

It may be less attractive, but that would provide comfort for banks and improve confidence in the system which is in short supply. Of course, the central bank can’t hold junk paper. To ensure that it may have to do an asset quality review, failing which, it may face blame like the ECB when it was holding junk Volkswagen bonds.

The RBI has started on ‘credit intervention’ to funnel loans to Main Street instead of just operating monetary policy. There’s more in the pipeline. Lenders better open the loans tap because there’s more to come. Don’t fight the Das!

When the Federal Reserve explored for ammunition in its arsenal beyond conventional tools during the global financial crisis, many like Jim Rogers who relied on conventional economics believed there wasn’t much at the central bank’s disposal. It was doom’s day. But the late Martin Zweig’s ‘Don’t fight the Fed’ adage gained currency as easy policies rolled on.

Central banks in the developed world resorted to many actions, one after the other, to prevent another Great Depression. From cutting interest rates to zero, to buying unlimited quantities of bonds — treasuries to mortgages — in unconventional monetary policy (UMP). More was in store whenever markets turned wobbly. Negative interest rates to buying corporate bonds which were part of academic research turned into reality.

UMP for India was not on the agenda because India couldn’t afford it as it had its own problems in high inflation, a soaring fiscal deficit and a ballooning current account deficit. So Indian monetary policy moved in the opposite direction.